Kisumu – Mama Grace Ouma

“Ametolewa nguo, tumeona uchi wake, alidhani yeye ni tajiri lakini hana kitu, alitegemea bwanake,” my neighbors whispered the day the shylocks came to my home, barely a month after my husband died. I hadn’t even begun to heal from his passing, and suddenly, my late husband’s debts were now my nightmare.

It was early morning when I heard the bell ringing at my gate. I opened the door to find two men in a V8 truck, carrying a large kengele, demanding that I sell my land to settle a Ksh 320,000 debt. My knees shook, and for a moment, I thought I would collapse. “Niliwapa maneno ya moyo wangu… nikaomba, ‘Nipe miezi sita nitakapo pata pesa zote.’” To my relief, they surprisingly agreed, leaving me with a tiny hope.

The first month was hell. I tried everything—selling some household items, borrowing from neighbors, skipping meals to save money—but the debt seemed impossible. “Nilijaribu kila njia… sikuwa na hata kitu cha kumsaidia mtoto wangu. Nilijua nyumba yetu ingeenda kwa mkopo ikiwa sitapata pesa.” I felt trapped, scared, and utterly alone.

It was during this time a friend introduced me to Dr Kshiririka, a man known for helping people in Kisumu who were trapped by debt or struggling with business. At first, I was skeptical. “Nilifikiri ni maneno tu ya ubatili… lakini nilikuwa nimechoka, nilihitaji msaada wowote,” I tell myself. Dr Kshiririka explained that with a small ritual—a money spell and a business spell—he could help me attract resources and opportunities, but I had to also put in effort.

With his guidance, I started a small business selling household items and groceries, using just Ksh 35,000 I borrowed from a neighbor. I was nervous; every shilling counted. The first week brought very little profit, and some days I wondered if I had made a mistake. “Nilijua maisha hayakuwa rahisi… siku zote niliogopa kuwa hata hii fedha ndogo ingekwisha.”

But slowly, things started to change. Within two weeks, I began seeing profits of Ksh 3,000 to Ksh 4,000 per day. It wasn’t huge, but it was enough to keep going and slowly save towards clearing the debt. I learned to manage my small business better—buying items that sold quickly, negotiating with suppliers, and keeping careful accounts. Gradually, the numbers added up.

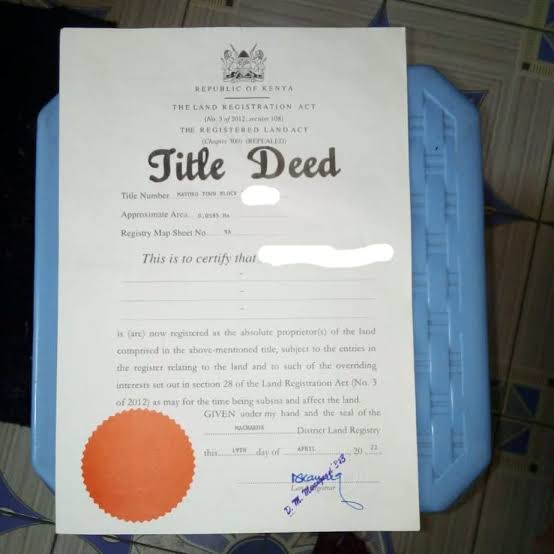

Three months into the venture, I had finally saved enough to pay off the Ksh 320,000 debt completely. Handing over the money to the shylocks was surreal. “Nilipowaona, nilijua tumepita hatari… nyumba ni yetu tena, na watoto wangu wapo salama,” I said, tears streaming down my face. Relief, pride, and gratitude overwhelmed me.

This journey taught me lessons I will never forget. Grief and financial pressure can crush a person, but perseverance, careful planning, and timely guidance can turn even the worst situation around. Today, my small business thrives, giving me not only income but confidence and independence. “Sasa ninaweza kulala salama usiku… hakuna hofu ya kupoteza nyumba au watoto wangu kulala njaa.”

I tell my story because I want other widows and struggling families to know that even in the darkest times, hope is possible. It may take sweat, patience, and sometimes a little unconventional help, but life can be rebuilt. From the day I almost lost everything to now, I have learned that determination and faith can restore both property and peace of mind.